File Form 940 Schedule R for 2023

E-filing Solution for PEOs/CPEOs & Section 3504 AgentsWhat is FUTA Tax?

FUTA- Federal Unemployment Tax Act, provides funds for those who are looking for unemployment compensation (i.e an employee who lost their job). Only the employer is responsible for paying the Federal Unemployment Tax and they should not withhold from their employee wages for the FUTA tax.

The employer has to contribute to FUTA for the first $7000 that they pay for their employee wages. Form 940 is used to report the Employer's annual Federal Unemployment Tax to the IRS.

Click here to learn more about Form 940 FUTA.

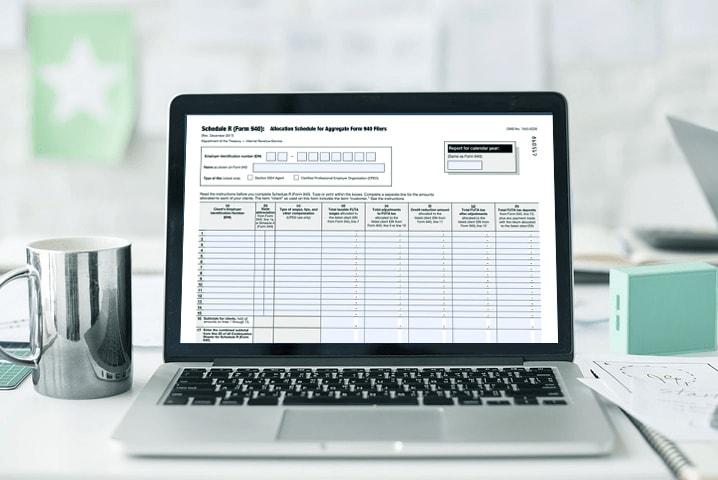

Form 940 Schedule R: Allocation Schedule for Aggregate Form 940 Filers

Form 940 Schedule R is mostly used by aggregate filers like CPEO or Section 3504 Agents to report the aggregate information of Form 940 for each of their clients who are treated as an Employer.

Form 940 Schedule R provides the IRS with the information about the Total taxable FUTA wages and the FUTA tax deposits made for each client along with the credit reduction information if any.

Visit, https://www.taxbandits.com/payroll-forms/e-file-form-940-schedule-r/ to learn more about 940 Schedule R.

What is Credit Reduction?

Generally, the FUTA tax rate is 6% for the wages of the first $7000 paid to each employee. And the employers will receive up to 5.4% of credits for their annual FUTA tax rate.

Some states request a loan from the Federal Agency if they aren't able to meet their state unemployment liabilities with the funds they have. These states are required to pay the amount back to the federal within the allotted time range. And if the states have an outstanding balance for two consecutive years and if they don't repay the loan amount, then the FUTA credits for the employers in that state will be reduced.

The Department of Labor provides a list of states each year with the subject to reduction in the FUTA credit. This credit reduction needs to be calculated using Form 940 Schedule A and needs to be attached along with the IRS Form 940.

For the tax year 2023, the credit reduction rate for California, Connecticut, Illinois, and New York is 0.6% and for the U.S. Virgin Islands is 3.6%.

What are the changes in Form 940 for the 2023 Tax Year?

The IRS revised the payroll tax form 940 and has changes in form 940 for tax year 2023.

1. There is change in Credit reduction rates for 2023:

| California (CA) | 0.6% |

| Connecticut (CT) | 0.6% |

| Illinois (IL) | 0.6% |

| New York (NY) | 0.6% |

| U.S Virgin Islands (VI) | 3.6% |

2. Electronically filing an amended Form 940:

Beginning sometime in 2024, the IRS expects to make filing an amended Form 940 electronically.

Previously there was only paper filing option for amended Form 940.

Who is responsible for filing Form 940 Schedule R

CPEOs/PEOs

All the CPEOs & PEOs file an aggregate return using Form 940 Schedule R, by using their own EIN. They are also responsible for filing the Forms which is listed on Form 8973, which is treated as a service agreement between the employer and the CPEO.

Section 3504 Agents

Not all the Section 3504 Agents files an aggregate return for Form 940. Only the employers who are treated as home care service recipients can get into the service agreement with the Section 3504 Agents by using the Form 2678 and can appoint an agent to report, deposit, pay and

file FUTA tax.

E-filing. It's Mandate!

Yes. The IRS has mandated the certification for the PEOs and it affects the employment tax liabilities of both the PEOs and their clients. The mandate certification also insists that the PEOs should file all their tax Forms electronically for their clients.

Meet your mandate IRS E-filing requirements with our easy to use Tax E-filing Solution. Either you have 1 client or 100,000 clients. Our system is capable of handling all your clients Form 940 data and help you to file your aggregate return Schedule R (Form 940) easily to the IRS.

Want to learn more about our product? Please Visit http://www.taxbandits.comto know more about the features that benefit you. Get Started Now with our E-filing Solution by Signing Up for free..

Deadline E-File Form 940 Schedule R

The due date to file your Form 940 Schedule R is January 31, 2024!

Form 940 isn’t due until February 10, 2024, if you have made all your FUTA Tax deposits on time when it is due for each quarter.

Meet your aggregate reporting for Form 940 Schedule R with our E-filing Solution. It's easy and free to get started.

Information Required to report your Aggregate Form 940 Schedule R

- Basic Information on CPEOs / 3504 Agents such as EIN & Name.

- EIN & State of all the clients.

- Type of wages, tips, & other compensation.

- Total of taxable FUTA wages & adjustments.

- Credit reduction amount.

- Total FUTA Tax Deposits made.

About 940 Schedule R E-filing Solution

940ScheduleR.com is a product from an IRS authorized e-file provider who is providing a various tax filing solution to businesses in the U.S. Our software is ideal for PEOs, CPEOs, and Section 3504 Agents. With our software, you will be also able to manage and e-file 940 all the other required tax forms such as Form 941 Schedule R, Form W-2, Form 1099, and ACA Forms without any hassle.

We provide a unique solution as per your tax filing needs and also offer you with flexible pricing based on the volume of the tax forms that you have. Contact us to know more about our pricing package that benefits you. And with our software you have never have to worry about the Form copies as we will print and mail the required copies to your employees and recipients on-time and helps you to stay compliant.

If you have any queries regarding our software, contact our customer support team who are ready to assist you and help you understand about our e-filing process. Our support team is located and operating from Rock Hill, South Carolina ensuring our clients get 100% U.S based customer support. Click here to know more about tax filing software.

Features that Benefits CPEOs/PEOs & Section 3504 Agents

- Have the flexibility of integrating your data with one of our data integration methods.

- Browse through the various clients and keep track of their filing status.

- Assign your co-workers the access to manage your clients business.

- You have the option to review the required Forms before transmitting to the IRS.

- Our system will ensure that your returns go through all the required IRS validation and also ensure that you are transmitting error-free returns with the IRS every time.

Bulk file your 940 Schedule R with one of these methods

Bulk Upload

Easily upload client data through Excel or CSV files.

API Integration

Expand your existing software and conveniently file your Form 940 Schedule R by integrating our API solution.

Custom Programming

Migrate your client's data from your existing system with little to no manual work.

Manual Entry

Enter client data one by one using our interview-style process.

How to E-file 940 Schedule R?

- Create your free account.

- Select either “CPEO or 3504 Reporting Agent” option to proceed.

- Enter your “Business Information” such as Name, Type, EIN, and Address.

- Select "File Aggregate Form 940 (Schedule R)" from the dashboard.

-

Enter the following information for both your business and your clients’ business.

- FUTA wages

- Credit Reduction Amount

- FUTA Tax after adjustment

- FUTA deposit details.

- Review your form summary, and transmit it directly to the IRS.

Do you know that?

You can also file the following Forms with our software.

Contact Us

Mail at support@TaxBanditscom

Call at (704) 684-4751

We are here to support you directly from 940ScheduleR.com, 2685 Celanese Road, Suite 100, Rock Hill, SC 29732.

Form W-9: Request for Taxpayer Identification Number and Certification

Invite your vendors to complete and

e-sign W-9

Form W-9 is an IRS tax form used by an individual or entity to request a person's name, address, Taxpayer Identification Number (TIN) and certification from a hired contractor or vendor to e-file the 1099 information returns. IRS Form W9 is known as Request For Taxpayers Identification Number and Certification Form.

With TaxBandits online portal, employers can request form W9 online and manage all W-9 forms at one place securely. Sign up now and request the first FIVE Form W-9 for FREE.